crypto tax accountant canada

Since crypto is still relatively new its essential to keep updated on the latest laws and regulations. Crypto taxes in Canada are confusing because there are so many use cases for crypto.

Additional Business Services Tax Consultant Toronto

We only list CPAs crypto accountants and attorneys.

. We are technically strong. Check out the directory of tax professionals. The crypto tax calculation software requires a deep technical understanding of how software operates and its limitations.

Ideally looking for a tax service where it makes it as easy as possible import your trade history and it does the rest. Many people put money into cryptocurrency without thinking about taxes. Crypto Capital Gains Canada.

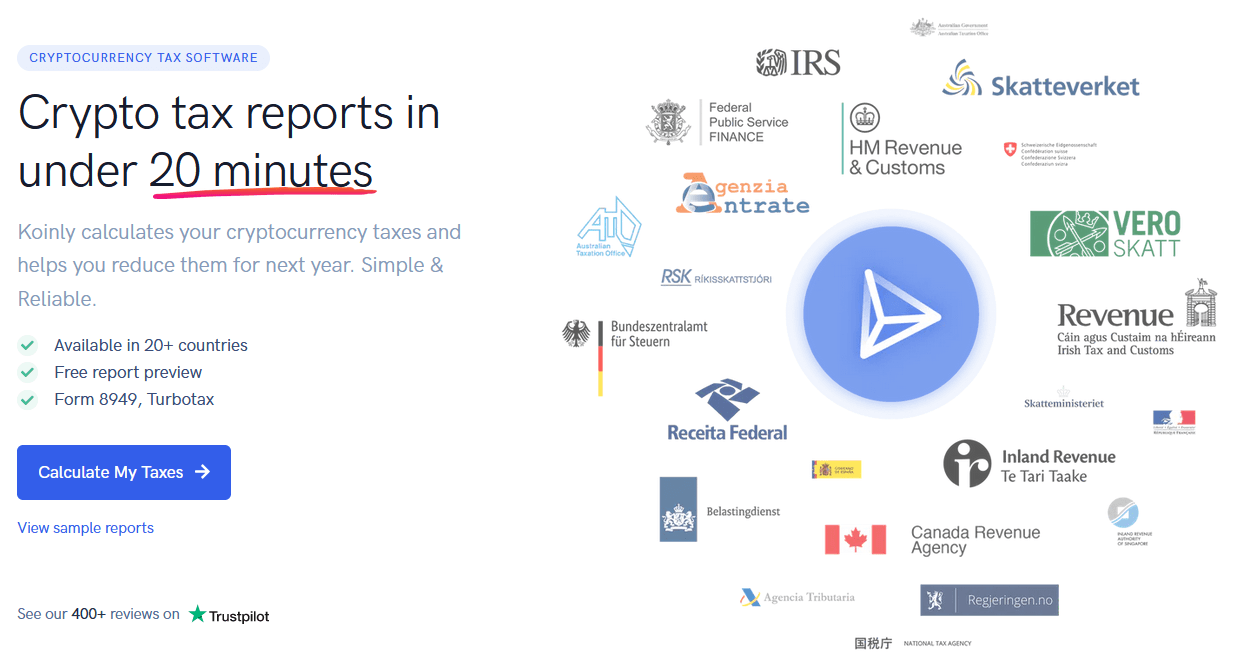

While we cant provide tax advice we want to present you with some information to make calculating your. Koinly is a cryptocurrency tax software for hobbyists investors and accountants. If youve profited from investments in Bitcoin Ethereum Litecoin Ripple or any other cryptocurrency then you need a crypto accountant that understands the tax implications of buying and selling cryptocurrencies.

Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. Find a certified tax professional specializing in cryptocurrency taxes to help with your declarations. Canada Revenue Agency has a publication that classifies Crypto or digital currencies as a form of property versus a form of money.

The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes which the Canada Revenue Agency CRA is. Wealthsimples smart tools even help you figure out and maximize your deductions to ensure you pay the right amount of tax with an optimized tax return. MetaCounts is a Vancouver Based Crypto accounting firm utilizing cutting-edge technology to provide a much-needed human experience to its clients.

You can use crypto as an investment as a currency for spending or as a source of passive income. Our expertise in other areas of accounting has allowed us to seamlessly transition into the crypto sphere providing valued accounting to investors large family offices venture capitalists and. You should speak to an experienced crypto tax accountant for bespoke advice on your investments and their subsequent taxation but we can look at the general rules on how business income and capital gains from crypto are taxed in Canada.

I only know of. Wealthsimple is a very popular choice for tax app in Canada - offering easy accurate and free tax filing with the CRA. Which canadian crypto tax services do you recommend.

Wealthsimple for crypto tax. The official Crypto Tax Accountant directory. You need to understand the technicalities behind missing transactions missing cost basis old non existant exchanges and the impact thereof.

How it works. Find a Bitcoin Accountant near you in Canada to help you with your cryptocurrency taxes. Koinly was built to solve this very problem - by integrating with all major blockchains and exchanges such as Coinbase Binance Kraken etc Koinly.

As a result cryptocurrencies are treated like stock and its gain or losses will be reported as either capital gains or business income. Posted by 1 year ago. See the different tax forms CryptoTraderTax generates.

This paper does not represent the views of the Canadian Accounting Standards Board AcSB or the International Accounting Standards Board IASB. You cannot take an approach of data in - tax report out. Introduction International Tax Coalition Targeting Cryptocurrency.

The way cryptocurrencies are taxed in Canada mean that investors might still need to pay tax regardless of if they made an overall profit or loss. Find a certified tax professional specializing in cryptocurrency taxes to help with your declarations. Learn how to reduce your crypto taxes.

Crypto and Canadian tax. March 31 2022 by admincryptoledger. Are you in need of a tax professional who specializes in bitcoin and cryptocurrencies.

Just wondering what everyone will be using. Crypto Accountants in Canada. Does anyone in the Calgary area know or recommend a Tax Accountant comfortable with crypto.

If youre dealing with cryptocurrency or a company involved in cryptocurrency you need experienced and committed accounting services of crypto tax accountant Canada. Paying taxes on cryptocurrency in Canada doesnt have to be a headache. In the summer of 2018 an international coalition of tax administratorsincluding the Canada Revenue Agency CRA and the United States Internal Revenue Service IRSpromised to pool their resources and expose cryptocurrency users who dodged their tax obligations.

Crypto Tax Accountant - Calgary. We are one of the first blockchain accountants in Canada and have been working with a lot of different companies from the team of Ethereum to bitcoin mining companies investors developers crypto exchanges and other blockchain start-up ventures. Report crypto on your taxes easily using Koinly a crypto tax calculator and software.

Our tax specialists are experienced in cryptographic tax transactions We are abreast with the rapidly evolving field of cryptocurrency and the changing laws Our clients can focus on their core business and leave crypto accounting services of crypto tax accountant Canada. I prefer an accountant - they double check the numbers and have a better ubderstanding. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes.

CryptoTraderTax is rebranding to CoinLedger. At Tohme Accounting we understand the needs and requirements of crypto accounting in Montreal and provide services related to blockchain technology and cryptocurrency trading. All companies listed here are well versed with cryptocurrency trading mining and other forms of crypto income.

4 Easy Steps To Prepare Your. We only list CPAs crypto accountants and attorneys. Crypto Accountants in the United Kingdom.

Depending on your circumstances taxes are usually realised at the time of the transaction and not on. Crypto Tax Accountant - Calgary. Get started today and maximize your refund.

However the fact is that cryptocurrency has specific tax implications for investors to consider. All companies listed here are well versed with cryptocurrency trading. 2 An Introduction to Accounting for Cryptocurrencies Disclaimer This paper was prepared by the Chartered Professional Accountants of Canada CPA Canada as non-authoritative guidance.

Koinly Tax Report App Review 2021 Best For Us And Canada

5 Best Crypto Tax Software Accounting Calculators 2022

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

The Ultimate Canada Crypto Tax Guide 2022 Koinly

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Do I Pay Crypto Taxes In Canada 2022

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Cryptocurrency Taxes In Canada Cointracker

Best Crypto Tax Accountant In Canada Sdg Accountant

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

Successful Accountants Tax Plan For Cryptocurrency Corvee

8 Ways To Avoid Crypto Taxes In Canada 2022 Koinly

2022 Canadian Crypto Tax Guide The Basics From A Cpa R Bitcoinca

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

The Ultimate Canada Crypto Tax Guide 2022 Koinly